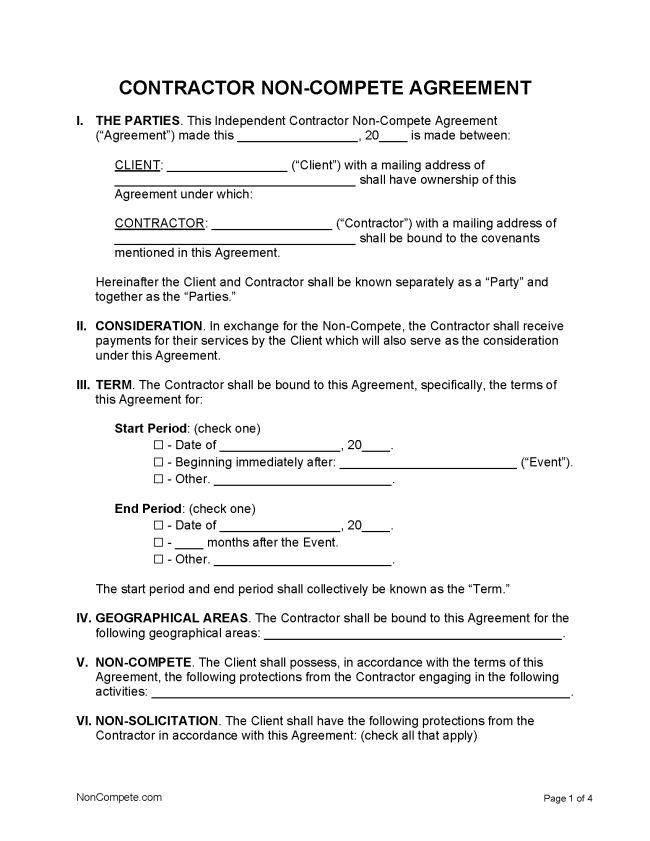

A contractor non-compete agreement is for a 1099 employee that is hired and prohibited from performing the same services for another employer. The enforceability of a non-compete for a contractor falls under the same laws as a w-2 employee. Therefore, a contractor cannot legally enter into a non-compete if performing work in the states of California, North Dakota, Oklahoma, and Washington D.C. A contractor and subcontractor are viewed under the same enforceability under state law.

A non-compete for a contractor will also include other terms regarding non-solicitation, non-disclosure, and confidential information.

Non-Compete Clause (independent contractor agreement)

Non-Compete. The Contractor agrees to limit their ability to perform the same services provided in this Agreement for a third (3rd) party (“Non-Compete”). The Non-Compete shall be in effect for the term of this Agreement and continue for a period of [#] months after its termination. The governed areas of the Non-Compete shall be for the geographical areas of [JURISDICTION].

Related Agreements (2)

Independent Contractor Agreement – It is common to have a non-compete be ancillary to an independent contractor agreement. It is recommended to have all agreements be under 1 wider-ranging contract.

Independent Contractor Agreement – It is common to have a non-compete be ancillary to an independent contractor agreement. It is recommended to have all agreements be under 1 wider-ranging contract.

Non-Disclosure Agreement (NDA) – An alternative to a non-compete is requiring a contractor to sign a non-disclosure agreement (NDA). An NDA requires that the contractor NOT share any information shared with a 3rd party or apply it in future work for someone else.

Non-Disclosure Agreement (NDA) – An alternative to a non-compete is requiring a contractor to sign a non-disclosure agreement (NDA). An NDA requires that the contractor NOT share any information shared with a 3rd party or apply it in future work for someone else.